Ready to Learn More?

As I’ve alluded to you throughout this article, there are a ton of great resources for learning more about achieving financial independence. Here are a handful to get you started:

- The BiggerPockets Money Podcast: Hosted by Scott Trench and Mindy Jensen, this podcast offers a wide variety of personal finance stories, spanning the spectrum of the FIRE movement. You’ll hear financial independence stories from people who worked their way out of extreme financial hardship, from high-income earners to low-income earners, from young retirees to people who started late, from couples with kids to aspiring entrepreneurs, etc.

- Other podcasts and blogs: There seems to be a FIRE-related podcast or blog to fit pretty much any personality! A few to start with include Mr. Money Mustache, Afford Anything, ChooseFI, and Mad Fientist.

- Playing With FIRE: This new documentary follows one family as they change their money mindset and begin their journey to financial independence.

- Books: Some classics to look into include Your Money or Your Life (Vicki Robin and Joe Dominguez), The Millionaire Next Door (Thomas Stanley and William Danko), The Simple Path to Wealth (JL Collins), and Set for Life (Scott Trench).

Sources:

https://fred.stlouisfed.org/series/PSAVERT

You’re reading about financial independence, so I’m assuming you’re interested! If you have yet to start your journey, what’s holding you back? Do you have any questions for me?

Let’s talk in the comment section below.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Нужны идеи

В 25 муниципалитетах Свердловской области уже действуют дочерние организации «Силы Урала». Идет создание волонтерских организаций там, где их пока нет. Местные власти, по словам В. Овчинникова, поддерживают добровольческое движение, предоставляют помещения для мероприятий, приглашают жителей принять участие в акциях, где требуется помощь волонтеров.

Волонтерам приходится работать с разными социальными и возрастными категориями. Это касается и крупных мероприятий типа Чемпионата мира по футболу, и небольших.

Сфера деятельности волонтеров разнообразна. Поскольку действуют они по собственному порыву, а не по приказу, то в основном их усилия сосредоточены на социальной помощи и обслуживании крупных мероприятий. Однако постепенно появляются новые направления для приложения сил.

Хорошие идеи бывают совершенно неожиданными. Одна моя знакомая навещала подругу в хосписе. И однажды ее осенило: она стала приносить пациентам по утрам горячий кофе. Для людей, изможденных страшным недугом, глоток капучино или эспрессо был как глоток свежего воздуха.

What is the reason behind its growing popularity?

The reasons for pursuing financial independence are likely to differ widely amongst individuals.

Some may see Financial Independence, Retire Early as a way of escaping the drudgery of working for a living. Others may see the movement as a way to focus more of their time on hobbies and interests.

Others, particularly younger people, may feel that working for a living simply isn’t as rewarding as a used to be due to the rising cost of shelter and decades of stagnant wages.

Changing attitudes to lifestyles should also be considered another factor. For example, advocates of FIRE may be less driven by consumer goods and more likely to find happiness through financial stability or other less-costly experiences.

Whatever your views on the FIRE movement, it’s always worth getting your finances in order.

Self-obsession

As I started considering FIRE, I realized all the ways I’m wasting my money.

When I start budgeting, I found the expenses I didn’t need and cut them out of my life.

When I started saving and investing, I realized that more of my money should go into a high-interest savings account instead of a high-end restaurant in the city.

In pursuit of financial independence, the only thing that mattered to me was economic self-sufficiency.

I never thought about others, or my relationship with them, because they would become roadblocks in my path to FIRE.

What we can lose in our goal of early retirement is our social awareness. We can lose sight of how this world is lacking and how we can help. We lose sight of how our friends are lacking and what we can do for them. We often treat ourselves like gods, believing that we deserve to live a certain lifestyle, leaving everyone else behind.

What to do about it

Something that was very pivotal for me was understanding the power of money to do good in this world and my ability to give.

We can always give something. Anybody nearing financial independence is almost always in a position to give. Maybe it’s of their income. Maybe it’s . There’s no hard-set rule. Either way, there is always a number of dollars or a percentage of our income we can joyfully give.

Giving includes but is not limited to:

- Tithing or donating to the local church

- Donating to non-profit organizations or charities

- Supporting your parents in their old age (in-home care, assisted living, etc)

- Saving money to respond to one-off needs that community members may have (emergency fund for others)

Some employers will actually perform similar 401(k) matching to charitable giving, allowing us to give maybe of pre-tax income while doubling it.

Passive income and passive outcome streams. As a result of all this, we can begin sectioning off a portion of our investments as our charity money, hoping to one day become financially independent with passive income streams as well as passive outcome streams. I may or may not have just made up this phrase, but I kind of like it.

What Can We Learn From Followers of FIRE?

What FIRE followers can teach everyone:

- They have a strong belief, point of view, approach, and commitment to achieving their goal of financial independence.

- They follow a specific method: ;ow expenses, extreme saving , investing for income, long-term view.

- They have a lot of good ideas about being efficient with money everywhere – not just investing.

- It’s about mindfulness, frugality, and being happier with less.

- They are (wisely) choosing time and freedom over money.

What may not work for more traditional people:

- It’s extreme – they are like the celebrity fitness trainer who people aspire to be, but don’t often fully become.

- If everyone did this and didn’t work in the traditional economy, our overall productivity growth might slow down. (This is assuming people focused on passive/rent seeking income and didn’t use their human capital to contribute to society as much as they could have, which may not be the case.)

- It requires a lot of time spent thinking about money and how to avoid spending it vs. enjoying today and being in the moment.

- Some of this has sprung up in the past decade alongside a some nice tailwinds in the stock market – many economists believe that future growth and stock returns will be lower.

- This approach may be easier if you’re younger and have a simpler situation – people who have been following a more traditional path and have more complex lives may find it more difficult to adopt some of these ideas.

What Is the FIRE Movement?

FIRE stands for “Financial Independence, Retire Early.” The movement is often traced back to the 1992 book Your Money or Your Life by Vicki Robin and Joe Dominguez. By comparing expenses to the time it takes working a job to earn each purchase, the authors strive to change readers’ relationships with money and encourage them to work toward financial independence.

Over time, more books and blogs began to surface on the topic of achieving financial freedom. The Mr. Money Mustache blog, started in 2011 by Peter Adeney, is frequently credited with popularizing the movement of simple, frugal living to achieve early retirement.

The exact definition of FIRE and how to achieve it varies quite a bit based on which book, article, or personal finance authority you stumble across. However, the most commonly noted pillars of FIRE include:

- Creating a significant gap between what you make and what you spend. This could mean increasing your income, decreasing your spending, or a combination of both.

- Using that gap to save and invest at a higher-than-average rate.

- Achieving financial independence at an earlier age than most—often in your 30s or 40s instead of in your 60s.

- Mathematically, financial independence is usually defined as a net worth of 25 times your annual living expenses. For instance, someone who can comfortably live on $60K per year should strive to achieve a net worth of $1.5M.

Overall, the aim is to obtain financial freedom as soon as possible through sound personal finance principles. Most proponents of the movement will tell you that it’s not so much about retiring early as it is about freeing up time to spend as you wish, before hitting the traditional retirement age of 65. This could mean cutting down to part-time work, leaving a 9-to-5 job to start a business, or stepping away to raise your children. In fact, there are many suggested alternatives to the “RE” in FIRE, including:

- Financial Independence, Retire Eventually: For those who could retire, but love their careers

- Financial Independence, Recreational Employment: For those who’d rather keep a low-stress, part-time job that they enjoy

- Financial Independence, Retire Entrepreneur: For those who would rather build a business or be self-employed

It’s often said that personal finance is personal, and FIRE is no different. The net worth number that equates to financial independence is different for every lifestyle. And the paths people choose to take after achieving financial independence vary as widely as the definitions of FIRE.

Блоги «ранних пенсионеров» из Америки

Само движение FIRE зародилось в США. Кстати, кому интересно, вот две книги, описывающие подробно всю концепцию раннего выхода на пенсию:

-

- «Кошелёк или жизнь» / 1992 год / Вики Робин и Джо Домингес

- «Экстремально ранний выход на пенсию» / 2010 год / Джейкоб Лунд Фискер

А вот список наиболее популярных молодых пенсионеров США, которые ведут свой блог в интернете и вдохновляют других людей собственным примером.

ЛАЙФХАК:«Перевести на русский» (в Google Chrome)

Root of Good — Джастин (автор блога) ушел на пенсию в 33 года благодаря тщательному контролю своих расходов. У него трое маленьких детей, и он наслаждается своим стилем жизни «раннего пенсионера». Сейчас он делает записи в своём блоге не так часто, как в начале, и основном все они о путешествиях.

Free at 33 — Джейсон — обычный парень с очень непростой судьбой, который смог достичь финансовой независимости. Он уволился с работы в 2014 году, чтобы стать блогером и фрилансером. Он начал собирать свой дивидендный портфель в 2010 году, и теперь дивидендный доход покрывает все его расходы на проживание. В настоящее время Джейсон ведет очень комфортный образ жизни в Таиланде, где стоимость жизни намного ниже, чем в США.

Financial Samurai — Пожалуй, один из моих любимых блогов. Автор блога Сэм ушел из финансовой корпорации, где получал приличные деньги, которые перестали быть для него основным движущим фактором. Сэм предпочел свободную жизнь, где он мог быть хозяином своих 24-х часов в сутках. Это стало его самой большой мотивацией. Он мечтал о том, как будет вести свой блог, проводить время с семьей, путешествовать, при этом обеспечивая себя и свою семью пассивным доходом. Спектр его инвестиционных инструментов достаточно широк: недвижимость, акции, облигации, депозиты. Он написал книгу, которая так же является источником пассивного дохода. Сам же блог приносит автору 330.000$ в месяц!!! Сложно поверить, но это слова самого автора. (После такого заявления интернет пополнится ещё одним-двумя блогами на WordPress xD)

Go Curry Cracker — Джереми и Винни очень похожи на типичных Travel-блогеров, с одной лишь оговоркой: они всегда очень разумно подходили к своим расходам. Сегодня, когда им чуть больше 30 лет, они могут позволить себе путешествовать по миру вместе с маленьким ребенком и наслаждаться жизнью. И все это благодаря накопленному капиталу, который они сколотили вместе. Этот блог является примером хорошей командной работы, где муж и жена одна сатана идут к своей общей цели вместе.

Mr Money Mustache — или «Усы Мистера Деньги», как говорит Википедия. Пожалуй, именно этот блог является флагманом среди всех блогов тематики FIRE. Пит и его жена ушли с работы в возрасте 30 лет. Автор этого блога сделал больше, чем кто-либо, для популяризации досрочного выхода на пенсию (движения FIRE). Его заметки очень вдохновляют. Читая его размышления, я понимаю что они целиком и полностью совпадают с моими внутренними убеждениями и ценностями. Жаль, что сейчас «Усы Мистера Деньги» (мне нравится его оригинальное название) очень редко пишет новые посты.

Retire by 40 — блог бывшего инженера-программиста фирмы Intel, который решил изменить свой образ жизни. Работа в Intel стала подрывать нервы и здоровье, а такое очень часто бывает в крупных корпорациях. До увольнения мужа у семьи был некоторый капитал, который мог бы их прокормить при скромных расходах. Когда беременная жена узнала, что муж увольняется с работы и решает вести блог с названием «выйти на пенсию в 40 лет» — она покрутила пальцем у виска. Однако, деваться было некуда, поэтому пришлось поверить мужу и поддержать его безумную идею. Сейчас у семьи 3 источника дохода: доход от накоплений, доход от блога, зарплата жены. Да, вы скажете «вот альфонс», но нет. Жена работает, потому что любит свое дело, а не потому что нуждается в деньгах. И это прекрасно!

Early Retirement Extreme — один из родоначальников данного движения Джейкоб Лунд Фискер. Он, кстати, автор книги, которую я указывал несколько абзацев назад.

Есть ещё сотни блогов, которые ведут последователи FIRE. Я указал лишь самые популярные и интересные. Их гораздо интересней читать, чем просто сайты с новостями фондового рынка или с обзором кредитных карт.

Examples of the FIRE Movement

I’ve been reading a lot of blogs from people living the FIRE lifestyle and thought the following list would provide a good overview.

- Mr. Money Mustache – Financially independent by 30. Married, has kids, and living downtown in a small city (100,000 people) in Colorado. Two million monthly visitors pretty much sums it up. He’s probably got the best mix of engaging writing, living the example, site usability, and strong community. Takes care of his family and lives a great life for less than $25,000 per year.

- Early Retirement Extreme – Financially independent by 30. Married, no kids, and able to live on $5,000 to $7,000 per year with a net worth greater than 100 years consumption. A more technical and denser blog written by a person with a lot of intellectual curiosity.

- Mad Fientist – Financially independent but still working since software developers are being paid a lot these days. Married. Lives in Pittsburgh PA. Writes and also does Podcasting about FIRE. Newer, more polished, and a more commercial presence.

- Get Rich Slowly – JD Roth – maybe the OG (original) personal finance blogger with a rags to riches story. He built Get Rick Slowly and sold that to Quinstreet and did well. He’s thoughtful, and like many people doing this, his blog shows that it’s much more about leading a mindful life than piling up money and achieving financial independence. He lives in Portland, Oregon.

- Frugal Woods – Married, one kid, and a dog. They left the city and started a farm in rural Vermont. It’s clear that living a simple, frugal life can be pretty rich, rewarding, and less stressful. They recognize that they are lucky – they also saved 71% of their income and only spent $13,000 outside of their mortgage in 2014.

- JL Collins – He keeps it simple. You have to appreciate the simplicity of his portfolio and his rationale for owning each position. He’s more experienced (older) than other people on this list and it sounds like he had a more traditional trajectory that has served him well.

Is FIRE right for you?

The FIRE movement is growing in popularity as people become increasingly aware of the importance of financial independence.

However, FIRE is a process that is inherently built with great friction. It can be physically painful to take on extra work to make more money, save money on things you love – like bubble tea or short getaway holidays. It is also painful to have to cut expenses or downgrade your lifestyle like going from a BMW to a 2nd hand Toyota.

Hence, before you decide to join the FIRE community, it’s important to ask yourself if it’s right for you.

FIRE can be a great option for those who are disciplined and able to live frugally. However, for those who are used to a more comfortable lifestyle, it may be difficult to adjust to a more modest budget. In addition, those who are not good at saving money or investing may find it difficult to achieve financial independence.

Ultimately, you have to find the balance between enjoying your current lifestyle versus being able to retire earlier. Whether or not FIRE is right for you depends on your individual circumstances and financial goals.

But wait, there’s more.

Not everyone likes the idea of introducing extreme lifestyle changes. Hence, over the years various types of FIRE emerged and flourished, giving aspiring FIRE folks more options.

Here’s a quick overview:

What I’d Need to Truly Retire Early

My biggest contention with the entire FIRE movement is that people have it in their minds that they can live off of a paltry amount of money by paying off one-time expenses and having a nominal amount in the bank (in this case, nominal being several hundred thousand dollars).

Sadly, life has a way of ensuring it is not as easy as that and one-time expenses, inflation, lifestyle changes, and other bills really throw a wrench into the already flawed concept. It is because of this that I think people significantly underestimate what they really need.

For us to truly retire I believe we would need, in cash after tax, just over $2,750,000.

This is a number that is absurdly higher than most you’ll ever hear in FIRE movement success stories (if only because, again, who in their 20s and 30s can actually save this much outside of those in the top 0.1%?).

I came up with this number based on a simple calculation:

Принципы, по которым живут активисты FIRE

Участники FIRE не полагаются на пенсию от государства — вместо этого они копят деньги самостоятельно. Накопленные деньги должны обеспечивать примерно такой же пассивный доход, как и текущая зарплата.

Причем методы накопления участников движения довольно радикальны.

Тотальная экономия

Обычно авторы книг о финансах советуют откладывать 10—15% от зарплаты. Участники движения FIRE считают, что стоит откладывать как минимум 50%, а еще лучше — 75%. Эти числа исходят из предположения, что если откладывать 75% от зарплаты, то за 10 лет можно накопить на 30 лет жизни с текущим уровнем расходов. А если откладывать всего 50%, то на 30 лет пенсии придется копить 30 рабочих лет.

Поэтому многие активисты решают ограничивать себя во всем, чтобы быстрее достичь желаемого уровня пассивного дохода. Они не ходят в рестораны, не покупают дорогую технику, не тратятся на путешествия и развлечения. Вместо этого откладывают деньги и инвестируют их в ценные бумаги и недвижимость.

Не все участники движения FIRE считают, что нужно ограничивать себя во всем: главное, отказаться от ненужных трат. Не покупать смартфон каждый год, отдыхать не на далеких пляжах, а в своей области, обновлять гардероб только тогда, когда одежда придет в негодность. Пока есть силы и возможность, нужно работать и зарабатывать деньги, а отдохнуть и потратиться можно на пенсии.

Я придерживаюсь умеренного подхода. Пока что откладываю треть от доходов, через год планирую откладывать половину. Пока еще не получается полностью отказаться от походов в ресторан или доставок еды — я очень люблю это. Зато я серьезно сократил расходы на технику, развлечения, одежду, путешествия и спонтанные траты.

Правило 4%

Правило 4% — одна из важных идей в основе FIRE. Чтобы накопленного капитала хватило хотя бы на 30 лет пенсии, в первый год выхода «на пенсию» из него можно взять не более 4%.

Далее расходы нужно индексировать на уровень инфляции. Допустим, в первый год инвестор забирает из капитала 1 млн рублей, а инфляция за тот год — 5%. Значит, на второй год инвестор забирает из капитала 1,05 млн рублей.

Некоторые идеологи советуют брать эту сумму не из накопленных денег, а из процентных доходов: дивидендов и купонов. При такой стратегии поступление денег может быть лучше защищено от кризисов и волатильности на рынке, чем при стратегии, основанной на продаже части подорожавших активов.

Если следовать правилу 4%, то капитала должно хватить хотя бы на 30 лет жизни. По крайней мере, так исторически получалось в США при портфеле, где акций 50% и больше, а остальное — надежные облигации. Для других стран и другой стратегии результаты могут быть другими: правило 4% не всегда работало вне США и вряд ли сработает, если держать все деньги на вкладах. Также стоит учесть, что результат стратегии в прошлом не гарантирует ее результат в будущем.

How much money do I need for FIRE?

While most FIRE practitioners aim to save about $1 million, your personal FIRE amount will vary with your lifestyle.

To calculate how much money you need to FIRE, you can use the 25x Rule.

What is the 25x rule?

The 25x Rule is a general savings guideline for retirement that suggests you should save 25 times your annual expenses in order to retire.

25 is not a number plucked from the skies randomly. It is based on a research paper known as the Trinity Study. This will give you enough money to live off your savings for the rest of your life, based on a withdrawal rate of 4% per year and serves as a good estimate to how much you need to retire.

It is also referred to as the FIRE formula. And the number you calculated using the 25x rule is often referred to as your “FIRE number“.

What is the 4% Rule?

The 4% Rule is a guideline for retirement savings withdrawals. The idea is to build a retirement fund that allows you to withdraw 4% of your savings each year without running out of money, even after adjusting for inflation.

Now that you have an estimate of how much you need to retire, you can estimate the amount of time it’ll take you to save for it.

FIRE practitioners aim to hit their retirement amount in a shorter time period.

The most hardcore FIRE fanatics may rely on unconventional methods, aiming to save 70-80% of their monthly/annual income while reducing their annual expenses.

Жесткая экономия ради досрочного выхода на пенсию

Идеология движения FIRE заключается в том, чтобы с первых лет получения дохода откладывать его большую часть, для того чтобы накопить пенсионный капитал, достаточный для полного ухода от активных заработков. Для этого потребуется жесткая экономия и отказ от многих благ сейчас ради получения этих благ легким способом в будущем.

Какой капитал для этого нужно накопить? Есть 2 варианта расчетов:

- Капитал, который человек просто будет тратить.

- Капитал, приносящий пассивный доход, который человек будет тратить.

Понятно, что в первом случае он может быть меньше. Как его рассчитать?

Если пренебречь инфляцией и доходностью от вложенных накоплений, то получится вот что:

- Если откладывать 10% дохода, то для накопления на 1 год расходов потребуется 9 лет;

- Если откладывать 25% дохода, то для накопления на 1 год расходов потребуется 3 года;

- Если откладывать 50% дохода, то для накопления на 1 год расходов потребуется 1 год;

- Если откладывать 75% дохода, то для накопления на 1 год расходов потребуется всего 4 месяца.

Таким образом, если начиная с 20 лет, откладывать 50% дохода, то к 40 годам накопится сумма еще на 20 лет жизни, к 45 годам — на 25 лет, к 50 годам — на 30 лет.

Big Ern – Early Retirement Now

Big Ern is the pen name of the guy who writes Early Retirement Now (his real name is Karsten, just revealed a short time ago when he quit his job!), probably one of the most, if not the most, technical and analytical FIRE blog. This makes sense because he has a Ph.D. in economics, has worked at the Federal Reserve in Atlanta and worked at the research department of a large investment manager. Not a lightweight.

If you are the type who loves data and analysis, this is the blog for you.

- The Blog: Early Retirement Now

- Follow on Twitter: @ErnRetireNow

- One of my favorites: The Ultimate Guide to Safe Withdrawal Rates – Part 1: Introduction is the first post in a 23-part series (not including reader case studies!) about safe withdrawal rates. You won’t find a more comprehensive look at this so don’t bother trying. But read it… and try to follow.

Related Articles

5 Retirement Withdrawal Strategies: How to Withdraw Funds

8 Best Strategies for Retirement Income

What is a Financial Plan and How to Make One

How to Retire Early: 7 Steps

Understanding Lifecycle Funds

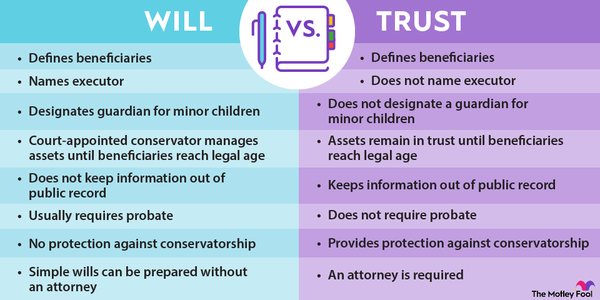

Will vs. Trust: What’s the Difference?

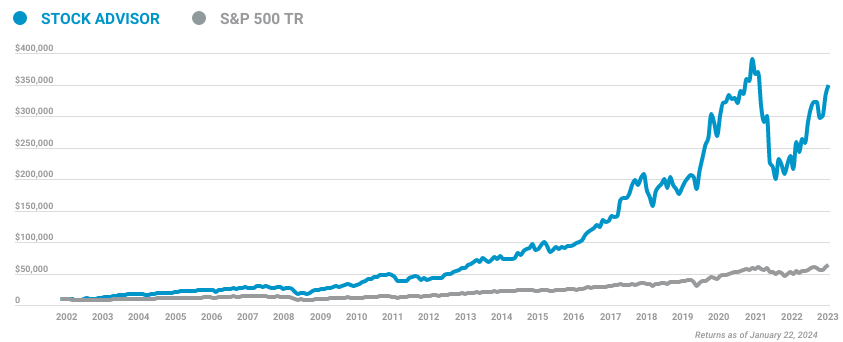

Motley Fool Returns

Market-beating stocks from our award-winning analyst team.

Stock Advisor Returns

661%

S&P 500 Returns

151%

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Returns as of 03/05/2024.

Discounted offers are only available to new members. Stock Advisor list price is $199 per year.

Join Stock Advisor

Cumulative Growth of a $10,000 Investment in Stock Advisor

Calculated by Time-Weighted Return since 2002. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Our Guides

5 Retirement Withdrawal Strategies: How to Withdraw Funds

8 Best Strategies for Retirement Income

What is a Financial Plan and How to Make One

How to Retire Early: 7 Steps

Understanding Lifecycle Funds

Will vs. Trust: What’s the Difference?

Everything You Need to Know About Deferred Retirement Option Plans (DROPs)

When Can I Retire?

Understanding Catch-Up Contributions

How Much Should You Contribute to Your 401(k)?

How to Save for Retirement Without a 401(k)

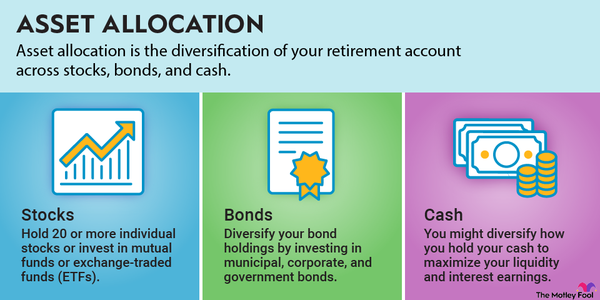

5 Things to Know About Asset Allocation

What are Target Date Funds?

How to Calculate Your Net Worth

Revocable Trust vs. Irrevocable Trust: Key Differences

Everything You Need to Know About Setting Up a Trust Fund

Live Beyond Your Means

This one is obvious. The only way to accumulate the money required to call yourself financially independent is to not spend it all. The higher your savings rate, and the lower your expenses, the sooner you will be FI. If your spending grows along with your income, you might save the same amount, but you’re actually delaying FI further by having higher expenses, therefore requiring a bigger nest egg. A smaller money requirement is just as important as the ability to acquire it, perhaps more so.

If you want to stay on track for FI or RE, strive for relative frugality when it comes to the big ticket items (house, cars, schools, etc…).

You can’t afford the Oprah suite, but you can take the tour.

You can’t afford the Oprah suite, but you can take the tour.

Final Thoughts on FIRE

Ultimately, I feel FIRE as a concept was an inevitability.

We do not work in a society that allows us to be fed based on the work of our choosing. Most of the time, we will be lucky to even be able to do something boring for a living.

To stay sane, we must have something to look forward to. It used to be Fridays, hence the prevalence of TGIF. Or the holidays. Or the year-end festivals. Endless amounts of people will tell you to find meaning in your work. To find joy in it.

I propose differently.

Work is simply a job. You do it to sustain yourself. And you do owe it to your employer to do it well while you are fairly compensated for it.

But don’t work for the sake of living.

Work for the sake of finding what drives you.

Work so that you can find what gives you hope. And excitement. And dream. Work so that you are afforded the time to find what you love.

Work so that you can then FIRE and live a life of meaning. Whether that means a lifetime of charity or a lifetime of reading books, that’s up to you.

Work so you can find your ikigai.

Without finding your ikigai, being successful at FIRE would merely upgrade you from a life Financially Insecure Meaninglessness to a life of Financially Secure Meaninglessness.

So what if you FIRE then?

- What are you going to do? Travel the world indefinitely? Then what?

- What makes you so inexorably excited about life that you can’t wait to wake up in the morning?

- What makes you so excited that you would hate to sleep at night?

Find the answer to these questions. And the motivation and inspiration to FIRE successfully – if that is even what you want after still – will come naturally to you.